Some people have asked me about how loans are different from ISAs. Here is an important fact. At its heart, a loan is also an income share agreement, because you are paying off your loan from your income, thus “sharing†your income!

Here is the key difference between an ISA and a loan that few people mention: in a regular income share agreement, the income share rate is fixed, and in a loan, the income share rate automatically increases precisely when your income and your ability to repay decreases.

Consider the following example. Take an ISA designed to fund $10,000 at 2.5% income share rate for and a similar loan at a 7% interest rate. Both are 10-year financing. The ISA has a minimum income threshold of $30,000, which is the annualized income below which you do not pay anything. These numbers are calibrated to keep the loan and ISA payments at similar levels at an annual income of $50,000.

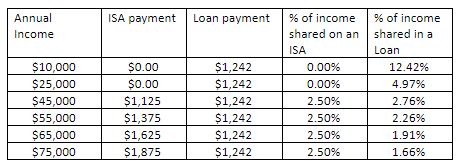

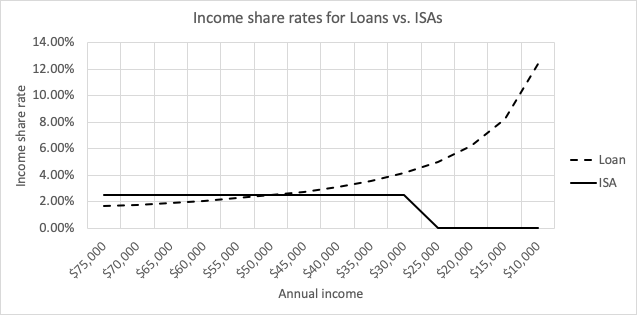

Table 1 and Figure 1 below show the annual payment on an ISA vs. a loan and what percentage of one’s annual income they constitute.

TABLE 1: Income Share Rates for Loans vs. ISAs

NOTE: Loan numbers assume 12-month accrued and capitalized interest. All these calculations are available upon request.

FIGURE 1: Income Share Rates for Loans vs. ISAs

So, precisely when a student needs the option of reducing the portion of income they pay, the loan ramps it up! In this respect, loans impose a regressive tax-like payment structure relative to income share agreements. Certainly, one can design predatory ISAs just as someone can design predatory loans. But an apples-to-apples comparison should reveal that loans are inherently designed to hurt when the borrower can least afford it.

Why is this option important for individuals seeking education? You are buying a product on faith that this education will benefit you, but you cannot be sure about how and when it will benefit you. You can also get hurt for things not accounted for in any placement data provided by the school, such as a recession caused by a pandemic. If you are buying a product with uncertainty about the value you will get from it, a pay-on-success model is usually better for the buyer (which is what an ISA provides).

The question for the borrower is then this – how much risk are you taking by using a loan, which is designed to eat up a bigger portion of your paycheck when you need to be protected the most, or an ISA that reduces your payment at lower incomes, and provides deferment when you don’t have income? The trade-off is that if you do well, then you may pay more on ISAs. Incidentally, this higher payment can be limited by an appropriate cap. So, the cap is an important part of the ISA model. Additionally, one should pay attention to early payment options on ISAs – unlike MentorWorks ISAs, many other programs currently do not have such options.

The comparison becomes even more stark when you consider that interest adds to principal balances in a loan and you have to pay interest on any unpaid interest (a double whammy). This means that loans ramp up the share of income you spend on loan payments even faster when have low income and limited means!

As always, the key is to understand the terms of the financing offer you have, how transparent it is, and act accordingly.